Liquidity pools are a type of financial instrument that can be used to manage assets and increase liquidity. They are increasingly becoming popular among investors and businesses alike, but how do they work?

In this blog post, we’ll provide an overview of liquidity pools and explain how they work. We’ll also discuss their potential benefits and some of the risks associated with them. By the end of this post, you’ll have a better understanding of what liquidity pools are and how they can be used.

What is a Liquidity Pool?

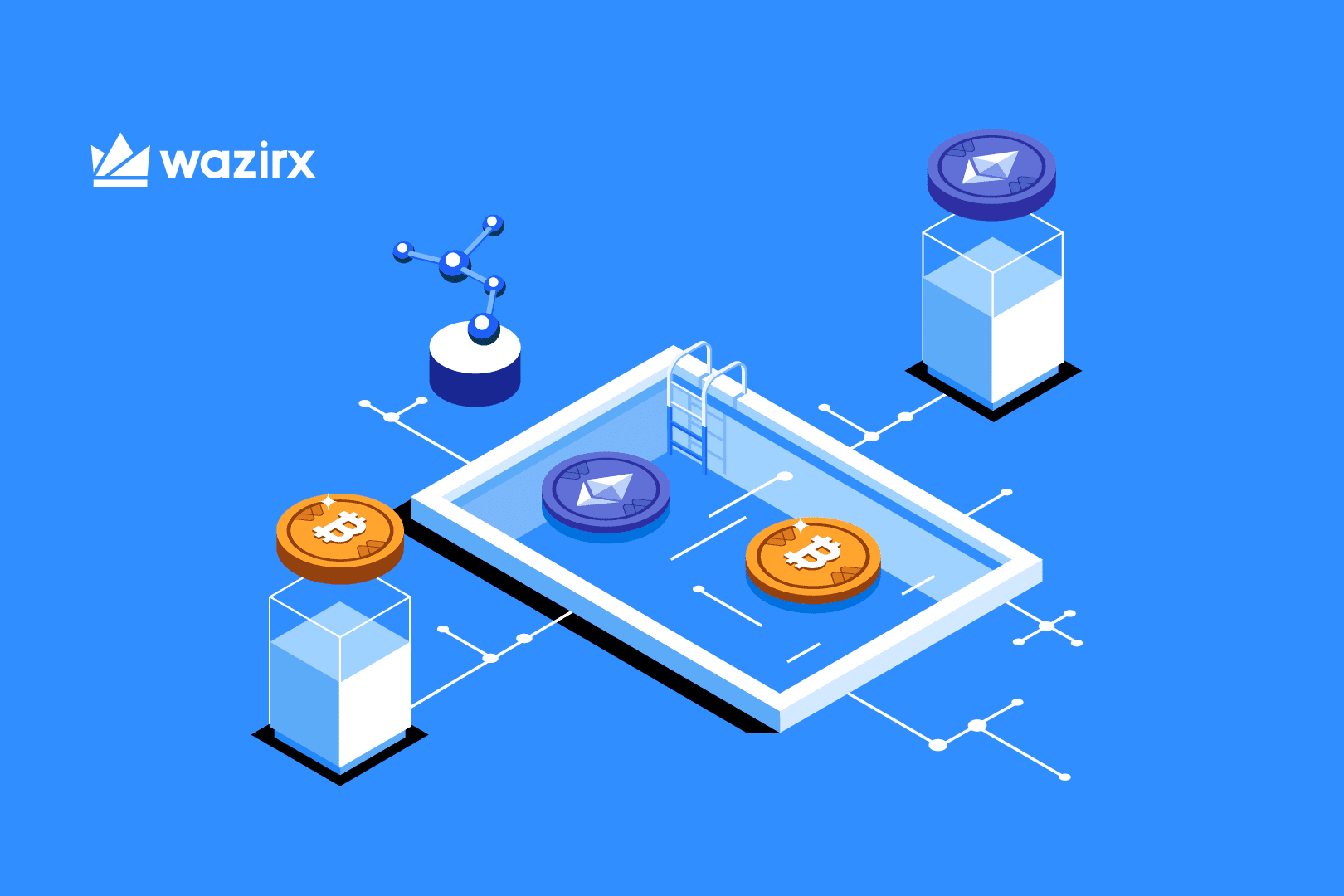

A liquidity pool is a reserve of funds or assets held in a smart contract that are used to facilitate trades on a decentralized exchange (DEX). In simple terms, it is a pool of tokens that are available for buying or selling. When users trade on a DEX, they are actually trading with this pool, not other traders on the platform.

Liquidity pools are a key component of the decentralized finance (DeFi) ecosystem as they provide liquidity for traders who are looking to buy or sell tokens. The liquidity pool ensures that there is always a constant supply of tokens available, even when the market is volatile and there are fluctuations in demand.

In order to contribute to a liquidity pool, users have to deposit an equal value of two different tokens. For example, if a user wants to contribute to an ETH/USDT liquidity pool, they would have to deposit an equal value of ETH and USDT tokens. In return for their deposit, users are given a certain number of pool tokens which they can later use to withdraw their share of the pool.

How Do Liquidity Pools Work?

Liquidity pools are essentially smart contracts that contain funds from various investors. These funds are then utilized for various decentralized finance (DeFi) applications, such as trading, lending, and borrowing. Users deposit their assets into the liquidity pool, which creates liquidity for trading pairs on DeFi platforms.

This means that users can swap one asset for another without the need for a centralized exchange, and liquidity providers earn a portion of the transaction fees.

The amount of fees earned by liquidity providers is proportional to their contribution to the pool. As more users trade on the platform, the liquidity in the pool increases, which leads to tighter spreads and lower slippage. However, if there are not enough trades happening on the platform, the liquidity in the pool can become imbalanced, leading to price fluctuations and impermanent loss.

To incentivize liquidity providers, many platforms offer additional rewards in the form of governance tokens or staking rewards.

In this way, liquidity providers can earn a steady stream of passive income while contributing to the growth of the DeFi ecosystem. Overall, liquidity pools play a critical role in ensuring that decentralized applications have the necessary liquidity to function efficiently.

Benefits of Liquidity Pools

One of the biggest benefits of liquidity pools is the fact that they allow for a more efficient trading experience. This is because there is no need for an order book, as buyers and sellers can simply exchange assets at a predetermined price.

This means that there is no need for intermediaries, which reduces transaction fees and ensures that trades are executed faster.

Another benefit of liquidity pools is the fact that they provide a way for traders to earn rewards in exchange for providing liquidity to the pool.

This is known as yield farming and has become increasingly popular in recent years. By contributing to a liquidity pool, traders can earn a share of the transaction fees generated by the pool.

Finally, liquidity pools also provide a way for traders to access assets that may be otherwise difficult to trade. For example, if there is low liquidity for a particular token on a centralized exchange, traders may be able to find more liquidity on a decentralized exchange that uses liquidity pools.

Overall, liquidity pools have become an important part of the cryptocurrency ecosystem and provide a number of benefits for traders. However, it is important to keep in mind that there are also risks associated with using liquidity pools, which we will discuss in the next section.

Risks of liquidity pools

While liquidity pools can be an excellent investment opportunity, it’s important to understand the potential risks involved. One of the most significant risks is the possibility of losing funds due to impermanent loss. Impermanent loss occurs when the value of one asset in a liquidity pool changes relative to the other, leading to the loss of potential gains.

Another risk to consider is the possibility of price slippage. This occurs when the price of an asset changes drastically due to market fluctuations, resulting in the loss of profits or increased trading fees. Furthermore, liquidity providers can be vulnerable to attacks or hacking attempts that can lead to a loss of funds.

Lastly, it’s essential to remember that liquidity pools are subject to the same risks as any other investment. The market can be volatile and unpredictable, leading to a loss of capital. As with any investment, it’s important to perform thorough research and only invest what you can afford to lose.

Types of liquidity pools

There are several types of liquidity pools that are commonly used in the world of decentralized finance (DeFi).

The first type of liquidity pool is a constant product pool, also known as an automated market maker (AMM) pool. This type of pool allows for the trading of assets without the need for an order book or a centralized exchange. The price of each asset is determined by the ratio of the two assets in the pool. This type of pool is commonly used for popular DeFi platforms like Uniswap.

Another type of liquidity pool is a bonding curve pool, which allows users to buy and sell tokens that are backed by a reserve of another asset. The price of the token is determined by a mathematical equation that takes into account the amount of the asset held in the reserve and the total supply of the token.

There are also multi-asset pools that allow for the trading of multiple assets in a single pool. These pools are useful for users who want to trade multiple assets without having to navigate multiple liquidity pools.

Finally, there are hybrid liquidity pools that combine the features of multiple pool types. These pools are more complex but offer more flexibility and customization options for users.

Each type of liquidity pool has its own benefits and drawbacks, and choosing the right one will depend on your specific needs and preferences.

Conclusion

Conclusion

Liquidity pools are an essential aspect of decentralized finance (DeFi) platforms that allow users to exchange digital assets seamlessly and efficiently. They serve as a meeting point for buyers and sellers to interact without the need for an intermediary or centralized authority.

As we have seen in this article, liquidity pools have their benefits, including reduced transaction fees, price stability, and quick execution of trades. However, they also pose significant risks, such as impermanent loss, hacking, and smart contract vulnerabilities.

Overall, the effectiveness and safety of liquidity pools largely depend on their type, the amount of liquidity provided, and the level of decentralization. It is, therefore, essential to conduct thorough research and seek professional advice before investing in these pools.

Despite the risks, liquidity pools are still a valuable tool in the DeFi space, and they continue to gain popularity. As the demand for more decentralized and cost-effective platforms grows, liquidity pools are likely to become more widespread, making them an exciting development to watch in the world of blockchain and cryptocurrency.