Litecoin is a decentralized cryptocurrency built on the Bitcoin protocol. It offers faster transaction speeds and lower transaction fees, making it one of the most popular and accessible cryptocurrencies today.

In an era dominated by digital finance, Litecoin stands out as a reliable alternative for both everyday transactions and long-term investments.

Additionally, Litecoin’s growing adoption among merchants and its compatibility with various payment systems make it a practical choice for anyone seeking to delve into the world of cryptocurrencies.

Earning Litecoin isn’t just a way to diversify your income; it’s an opportunity to participate in a financial revolution that’s reshaping how we perceive and use money.

This guide is designed to provide a comprehensive roadmap on how to earn Litecoin effectively, and cover everything you need to know from active methods like mining and trading to passive income opportunities.

7 Ways to Earn Litecoin

1. Buying Litecoin

One of the simplest and most direct ways to earn Litecoin is by purchasing it through a cryptocurrency exchange.

Platforms like Binance, Coinbase, and Kraken allow users to buy Litecoin using fiat currencies such as USD or EUR. Once purchased, you can transfer the Litecoin to your personal wallet for safekeeping or use it for transactions and investments.

This method is ideal for beginners who want quick access to Litecoin without engaging in more complex earning strategies.

2. Litecoin Faucets

Litecoin faucets are websites or applications that reward users with small amounts of Litecoin for completing simple tasks, such as solving captchas or watching ads.

These platforms are great for those looking to get started with cryptocurrencies without any upfront investment. Although the earnings are small, they can accumulate over time, especially if you participate in multiple faucets consistently. Popular Litecoin faucets include Moon Litecoin and Free-Litecoin.

3. Crypto Airdrops

Airdrops are promotional events where cryptocurrency projects distribute free tokens, including Litecoin, to eligible participants.

To qualify, you must typically complete specific tasks, such as following social media accounts or signing up for a platform. Airdrops are an excellent way to earn Litecoin without spending any money, but it’s essential to verify the legitimacy of the airdrop to avoid scams.

4. Affiliate and Referral Programs

Many cryptocurrency platforms and services offer affiliate or referral programs that reward users with Litecoin for bringing in new customers.

By sharing your unique referral link, you can earn a percentage of the fees or commissions generated by the people you refer. This method can be highly lucrative with a solid online presence or network.

5. Play-to-Earn (P2E) Games

Play-to-earn games are a fun and interactive way to earn Litecoin. These blockchain-based games reward players with cryptocurrency for completing missions, leveling up, or winning battles. P2E games often involve in-game assets or NFTs that can be traded for Litecoin or other tokens. Look for games specifically offering Litecoin rewards to maximize your earnings.

6. Reward Platforms

Certain platforms pay users in Litecoin to complete tasks such as surveys, watching videos, or testing apps. Websites like Cointiply and TimeBucks allow users to earn small amounts of Litecoin by engaging with their content. While the earnings are modest, they can add up over time and be an accessible introduction to the cryptocurrency ecosystem.

7. Giveaways

Litecoin giveaways are hosted by influencers, brands, or cryptocurrency projects as part of promotional campaigns. You must like, share, or comment on social media posts or complete simple activities to participate. Although giveaways are competitive, they offer a chance to earn Litecoin without any financial investment. Always verify the credibility of the giveaway to ensure it’s legitimate.

Why Choose Litecoin Over Other Cryptocurrencies?

1. Faster Transaction Speeds

One of Litecoin’s standout features is its speed. While Bitcoin transactions can take up to 10 minutes or more to confirm, Litecoin processes transactions in about 2.5 minutes. This fourfold increase in speed makes it ideal for everyday transactions, such as shopping online or transferring funds quickly.

2. Lower Transaction Fees

Another reason Litecoin shines is its low transaction fees. As the crypto market grows, high fees on popular networks like Ethereum and Bitcoin can deter users from making small or frequent transactions.

3. Widespread Adoption and Use Cases

Litecoin has been widely adopted by merchants, payment processors, and ATM networks, making it one of the most versatile cryptocurrencies. Its integration with popular platforms like PayPal and crypto debit cards means users can easily spend Litecoin at thousands of retailers worldwide.

4. Strong Development and Stability

Unlike newer cryptocurrencies that may lack a proven track record, Litecoin has been around since 2011, earning its place as one of the most reliable and stable digital assets. Its longevity in the volatile crypto market demonstrates a well-maintained network with robust development.

5. High Liquidity and Availability

Litecoin is one of the most traded cryptocurrencies globally, ensuring high liquidity across numerous exchanges. This liquidity allows users to buy, sell, or trade Litecoin quickly without worrying about price slippage or availability issues.

6. A Community-Driven Ecosystem

Litecoin benefits from a loyal and active community of developers, miners, and users. This robust ecosystem fosters continuous innovation and widespread support, ensuring cryptocurrency remains relevant in the evolving digital economy.

How to Sell Litecoin on SnappyExchange

1. Create or Log In to Your SnappyExchange Account

To get started on SnappyExchange, you need to create a new account; if you already have one, simply click ‘Log In,’ enter your email and password, and you’ll be taken to your account dashboard.

2. Go to the ‘Trade E-currency’ Section

After logging into your SnappyExchange account, click the ‘Trade E-currency’ section. This option is usually located in the main menu or on your dashboard. Click on it to open the trading interface.

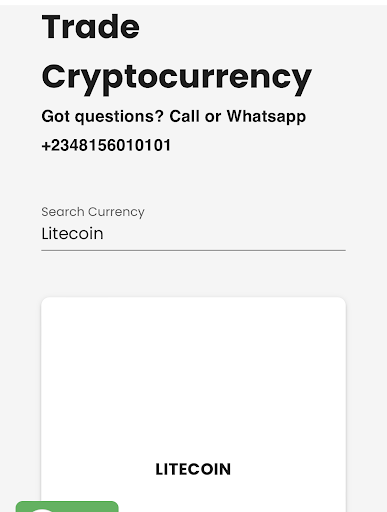

3. Scroll Down to Litecoin or Search Litecoin in the Box

In the ‘Trade E-currency’ section, scroll through the list of cryptocurrencies to find Litecoin or use the search box to locate it quickly.

Typing “Litecoin” in the search box will help you find the trading options for Litecoin more easily. Click on Litecoin.

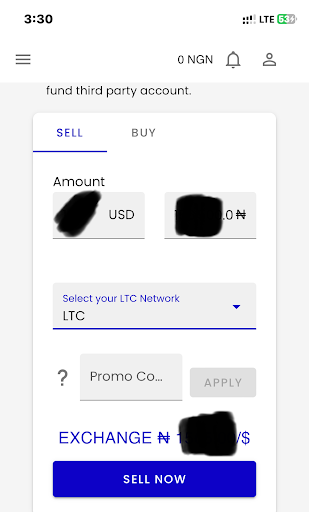

4. Fill in the Details and Click ‘Sell Now’

Enter the amount of Litecoin you want to sell and choose the correct LTC network. Double-check your details for accuracy, then click ‘Sell Now’ to begin the sale. This will start the transaction process and get your Litecoin ready for sale.

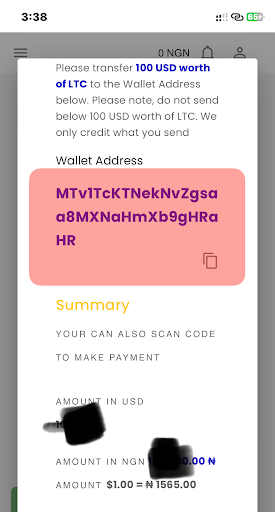

5. Transfer Litecoin to the Wallet Address Provided

To complete the sale, transfer your Litecoin from Trust Wallet to the wallet address provided by SnappyExchange.

Open Trust Wallet, find your Litecoin balance, and select ‘Send.’ Enter the wallet address from SnappyExchange and the amount of Litecoin you want to transfer.

Confirm and authorize the transaction. Once processed, SnappyExchange will receive your Litecoin and continue with the sale.

6. Confirm All Transaction Details and Continue

Before finalizing the transaction, carefully check all the details, including the wallet address and the amount of Litecoin you’re sending.

Once you’re sure everything is correct, proceed with the transaction. This step ensures that your Litecoin is transferred accurately to SnappyExchange and that the sale goes smoothly.

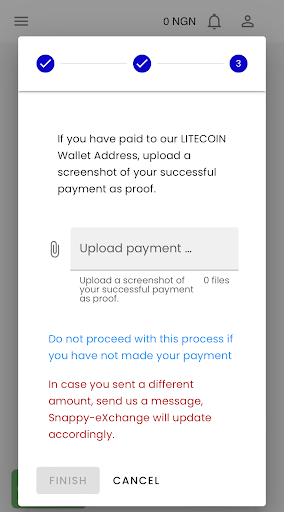

7. Upload Payment Screenshot and Click ‘Finish’

After transferring your Litecoin, upload a screenshot of the payment confirmation to SnappyExchange. Attach the screenshot of the payment, and click ‘Finish.’ This confirms your payment and finalizes the sale.

8. Wait for Transaction Approval

After submitting your payment screenshot, Wait for your transaction approval, which will take just a few minutes.

The dashboard allows you to monitor the progress of your transaction. The platform will review and approve your transaction, and you’ll receive a notification once the sale is complete.

9. Get Credited

Once the transaction is approved, the funds will be deposited into your SnappyExchange wallet. You can view the credited amount by checking your wallet balance on the SnappyExchange dashboard.

Read Also: How Can I Mine Litecoin

Conclusion

Litecoin offers many opportunities for anyone looking to dive into cryptocurrency earnings. There’s something for everyone, from straightforward methods like purchasing Litecoin on exchanges to engaging options such as earning through faucets, airdrops, and affiliate programs.

More innovative approaches, like Play-to-Earn games and completing tasks on reward platforms, provide entertaining and practical ways to accumulate Litecoin without substantial upfront investment.

When approached strategically, mining and trading Litecoin can be advantageous for those seeking more significant returns.

Litecoin is a proven and reliable choice. Its enduring presence in the market, coupled with a vibrant community and ongoing technological advancements, positions Litecoin as more than just an earning opportunity—it’s a gateway to participating in the future of decentralized finance.